Sophisticated Financial Advertising Made Simple

Meet customers with your products and services in the money moments that matter.

Extend Your Reach With Programmatic Advertising

Faced with new technology and changing customer expectations, financial services marketers are finding new ways to reach customers craving independence where they are—increasingly online. With our digital media expertise in financial services advertising, you can launch your targeted, personalized campaigns with ease.

Meet Your Customers During Life’s Financial Milestones

Banks and Credit Unions

Through location targeting, you can build an audience of customers who may have been to a specific branch, and then later target them with a personalized digital campaign promoting your products and services. Leverage our footfall attribution and measure how many users who saw your digital campaign actually visited your branch.

Wealth and Asset Management

Advisors, brokers, and wealth managers can customize a personalized ad experience across different channels. Upload your 1st-party data in minutes and launch a campaign to reach your target customer.

Personal Loans and Mortgages

Customers are increasingly doing research online before taking out a personal loan or applying for a mortgage. With our contextual targeting solution, you can reach your target audience based on the content they are searching for and reading.

Proven Solutions for Financial Marketers

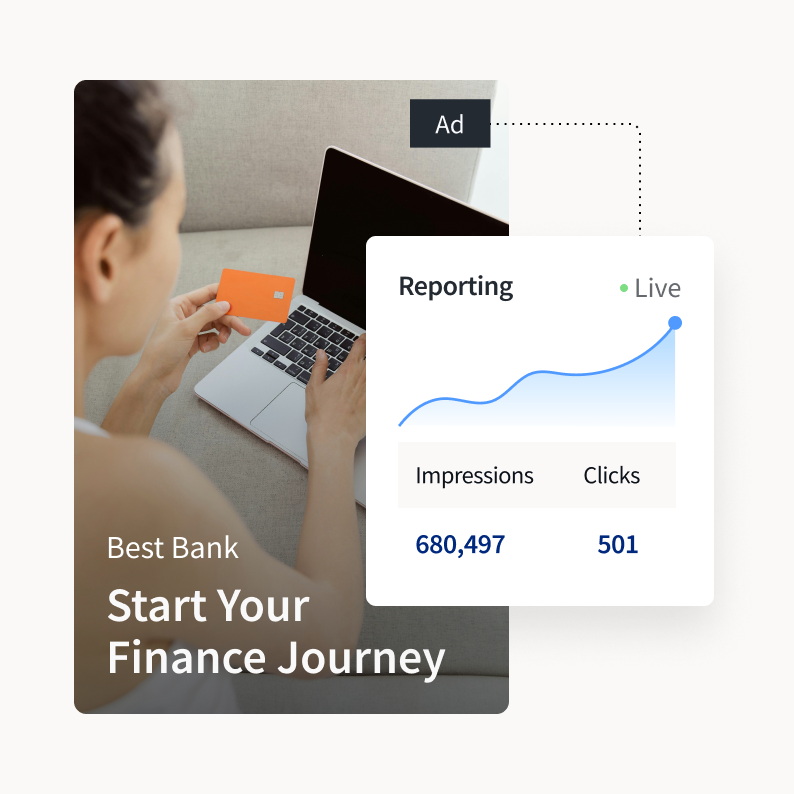

Measure the Impact of Your Financial Campaigns

We connect billions of data points to provide you with a dynamic reporting dashboard where you can gain insights on your campaign performance. Leverage StackAdapt’s reporting and break down campaign metrics like impressions, clicks, and conversions.

We Make Your Financial Ads Stand Out

Work with our Creative Studio team and build a digital ad campaign that will attract attention and engagement. Our design experts know how to make your interactive, rich-media display ads capture and convert.

Inspiring Case Studies

See how StackAdapt helped drive conversions for these brands in financial services.

Programmatic Provides Strong ROI for Financial Brand

Syfe Grows Leads With Cost-Effective Targeting

Connected TV Campaign Reaches Homeowners

Industry Resources

Webinar

EMEA

Jun 1, 2023

Digital Marketing Strategies for the Finance Industry